Navigating Rural Opportunities: A Comprehensive Guide To USDA Loans In Washington State

Navigating Rural Opportunities: A Comprehensive Guide to USDA Loans in Washington State

Related Articles: Navigating Rural Opportunities: A Comprehensive Guide to USDA Loans in Washington State

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Rural Opportunities: A Comprehensive Guide to USDA Loans in Washington State. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Rural Opportunities: A Comprehensive Guide to USDA Loans in Washington State

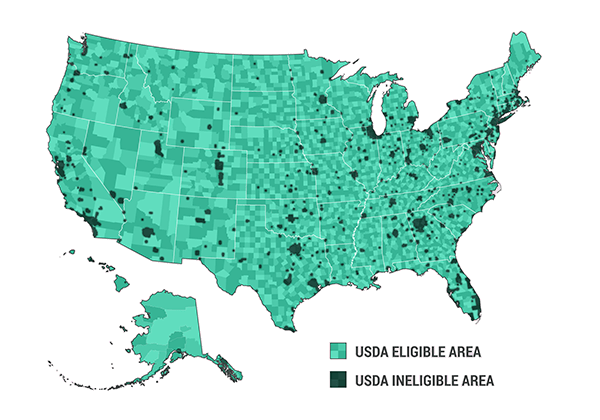

The United States Department of Agriculture (USDA) offers a range of loan programs designed to facilitate rural development and promote economic growth. These programs are particularly relevant for individuals and families seeking to purchase or improve property in rural areas, including Washington State. Understanding the intricacies of USDA loan programs and their eligibility requirements is crucial for maximizing these opportunities. This comprehensive guide delves into the USDA loan landscape in Washington, outlining the benefits, eligibility criteria, and essential steps for navigating the application process.

Understanding USDA Loan Eligibility in Washington

The USDA Rural Development program encompasses a variety of loan products, each tailored to specific needs and purposes. The most common types include:

- Single-Family Housing Loans: These loans are designed for individuals and families seeking to purchase, build, or rehabilitate a home in eligible rural areas. The program offers competitive interest rates and flexible terms, making homeownership more attainable for those who may not qualify for conventional financing.

- Multi-Family Housing Loans: These loans are available for developers and investors looking to construct, rehabilitate, or acquire multi-family housing units in eligible rural areas. The goal is to provide affordable housing options for low- and moderate-income families.

- Business and Industry Loans: These loans assist businesses and industries in rural areas by providing funding for expansion, modernization, or new ventures. The program aims to stimulate economic growth and create job opportunities in rural communities.

- Community Facilities Loans: These loans support the development of essential infrastructure and public facilities in rural areas, such as schools, hospitals, libraries, and water and sewer systems. The program aims to enhance the quality of life and provide essential services to rural residents.

Determining Eligibility for USDA Loans in Washington

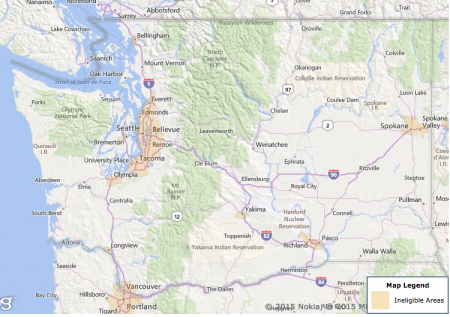

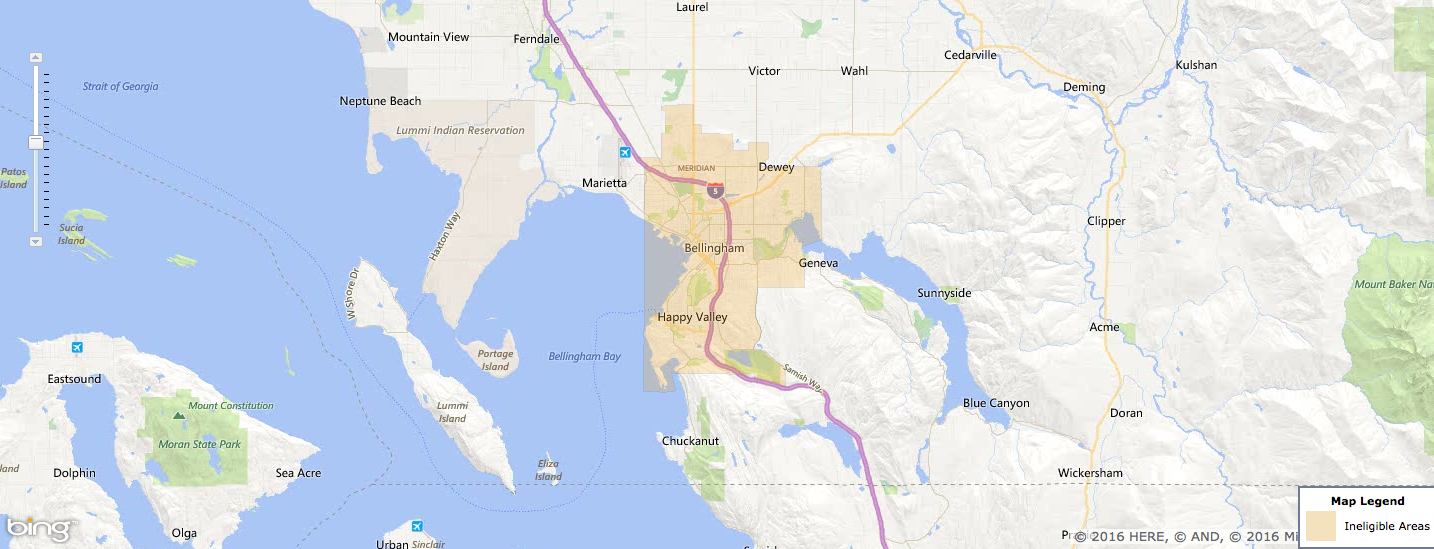

To qualify for a USDA loan in Washington, properties must be located in eligible rural areas. The USDA defines rural areas as those that are not part of a metropolitan statistical area (MSA) or a micropolitan statistical area (μSA). The USDA Rural Development website provides an interactive map tool that allows users to search for eligible areas by address or zip code.

Additional Eligibility Requirements for USDA Loans:

- Income Limits: Applicants must meet specific income limits based on the size of their household and the location of the property. These limits vary by county and are adjusted annually.

- Credit History: Applicants must have a satisfactory credit history, demonstrating their ability to repay the loan.

- Property Type: The property must meet USDA guidelines for size, condition, and suitability for occupancy.

- Debt-to-Income Ratio: Applicants must demonstrate a reasonable debt-to-income ratio, indicating their ability to manage their finances effectively.

The Benefits of USDA Loans in Washington

- Lower Interest Rates: USDA loans often offer lower interest rates compared to conventional mortgages, making them a more affordable option for homebuyers.

- Flexible Loan Terms: USDA loans provide flexible terms, allowing borrowers to choose loan lengths that best suit their financial situation.

- Lower Down Payments: USDA loans typically require a lower down payment compared to conventional mortgages, making homeownership more accessible to those with limited savings.

- No Private Mortgage Insurance (PMI): USDA loans do not require PMI, which can save borrowers significant costs over the life of the loan.

- Community Development Focus: USDA loans prioritize rural development and support the creation of jobs and economic growth in rural communities.

Navigating the USDA Loan Application Process in Washington

- Pre-Qualification: Before applying for a USDA loan, it is essential to get pre-qualified. This involves providing basic financial information to a lender, who will assess your eligibility and provide an estimated loan amount.

- Property Search: Once pre-qualified, you can begin searching for properties in eligible rural areas. Consult with a real estate agent who has experience working with USDA loans to ensure you find a property that meets the program’s requirements.

- Loan Application: Once you have found a suitable property, you will need to submit a formal loan application to a USDA-approved lender. The application process typically involves providing extensive documentation, including income verification, credit history, and property information.

- Loan Approval: After reviewing your application, the lender will make a decision regarding loan approval. If approved, you will receive a loan commitment outlining the terms of the loan.

- Closing: Once all necessary conditions have been met, the loan will be closed, and you will officially become the owner of the property.

Frequently Asked Questions (FAQs) about USDA Loans in Washington

Q: What are the income limits for USDA loans in Washington?

A: Income limits for USDA loans vary by county and are adjusted annually. You can find the current income limits for your area on the USDA Rural Development website.

Q: What are the credit score requirements for USDA loans?

A: While there is no specific credit score requirement for USDA loans, borrowers generally need a good credit history to qualify. Lenders may have their own credit score guidelines.

Q: What are the closing costs associated with USDA loans?

A: Closing costs for USDA loans are typically lower than those associated with conventional mortgages. However, they can vary depending on the lender and the specific loan terms.

Q: What are the property requirements for USDA loans?

A: USDA loans have specific requirements for the property, including size, condition, and suitability for occupancy. It is essential to consult with a lender or real estate agent to ensure the property you are interested in meets these requirements.

Q: What are the benefits of using a USDA-approved lender?

A: USDA-approved lenders have specialized knowledge of the program’s guidelines and requirements. They can provide guidance and support throughout the application process, increasing your chances of loan approval.

Tips for Success with USDA Loans in Washington

- Consult with a USDA-approved lender: Seek guidance from a lender who specializes in USDA loans to ensure you understand the program’s requirements and navigate the application process effectively.

- Work with a knowledgeable real estate agent: Collaborate with a real estate agent who has experience working with USDA loans to find suitable properties and avoid potential pitfalls.

- Prepare your documentation: Gather all necessary documentation, including income verification, credit history, and property information, to ensure a smooth application process.

- Be patient: The USDA loan process can take time, so be prepared for delays and setbacks. Stay in communication with your lender and real estate agent throughout the process.

- Understand the program’s guidelines: Thoroughly review the USDA loan program guidelines to ensure you meet all eligibility requirements and avoid potential issues.

Conclusion

USDA loans offer valuable opportunities for individuals and families seeking to purchase or improve property in rural areas of Washington State. By understanding the program’s eligibility requirements, benefits, and application process, potential borrowers can maximize their chances of securing affordable financing and achieving their homeownership goals. With careful planning and guidance from experienced professionals, navigating the USDA loan landscape can be a rewarding experience, leading to the realization of dreams and the revitalization of rural communities.

Closure

Thus, we hope this article has provided valuable insights into Navigating Rural Opportunities: A Comprehensive Guide to USDA Loans in Washington State. We hope you find this article informative and beneficial. See you in our next article!