Navigating The Landscape Of Opportunity: A Comprehensive Guide To Economic Opportunity Zones

Navigating the Landscape of Opportunity: A Comprehensive Guide to Economic Opportunity Zones

Related Articles: Navigating the Landscape of Opportunity: A Comprehensive Guide to Economic Opportunity Zones

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Landscape of Opportunity: A Comprehensive Guide to Economic Opportunity Zones. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Opportunity: A Comprehensive Guide to Economic Opportunity Zones

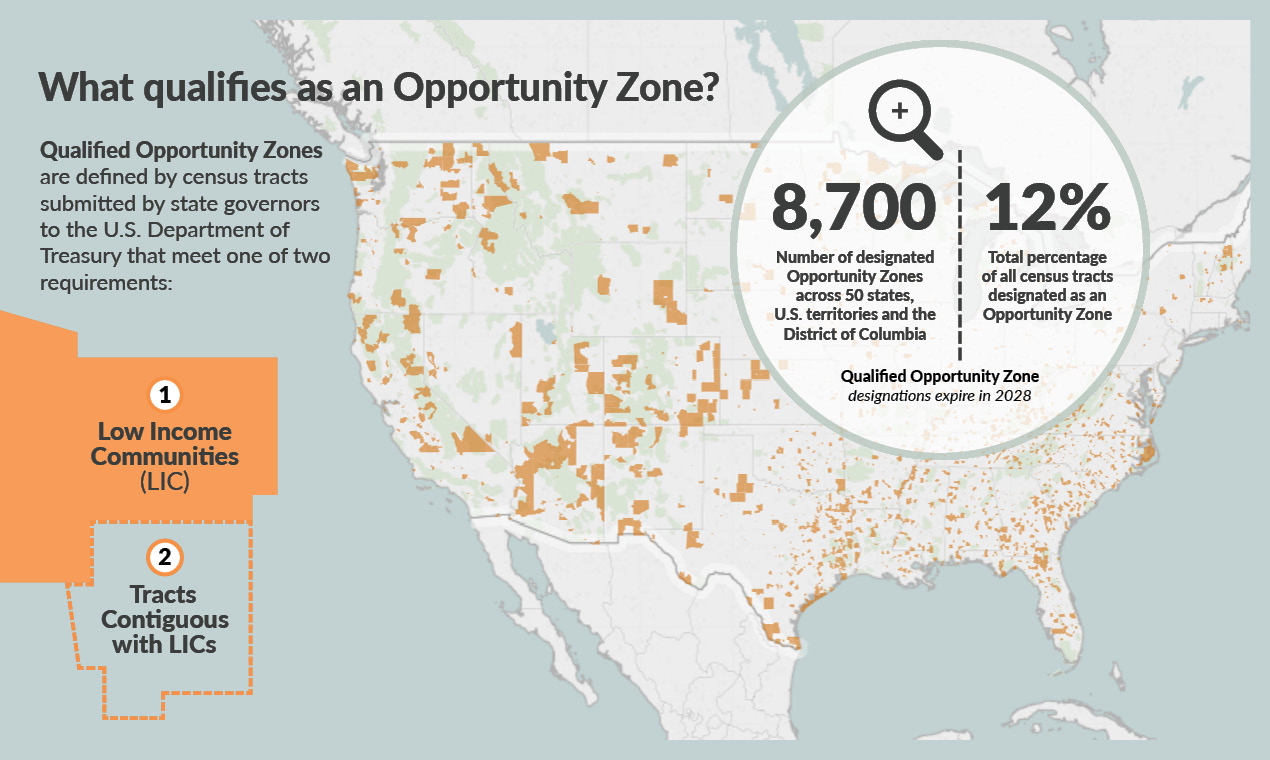

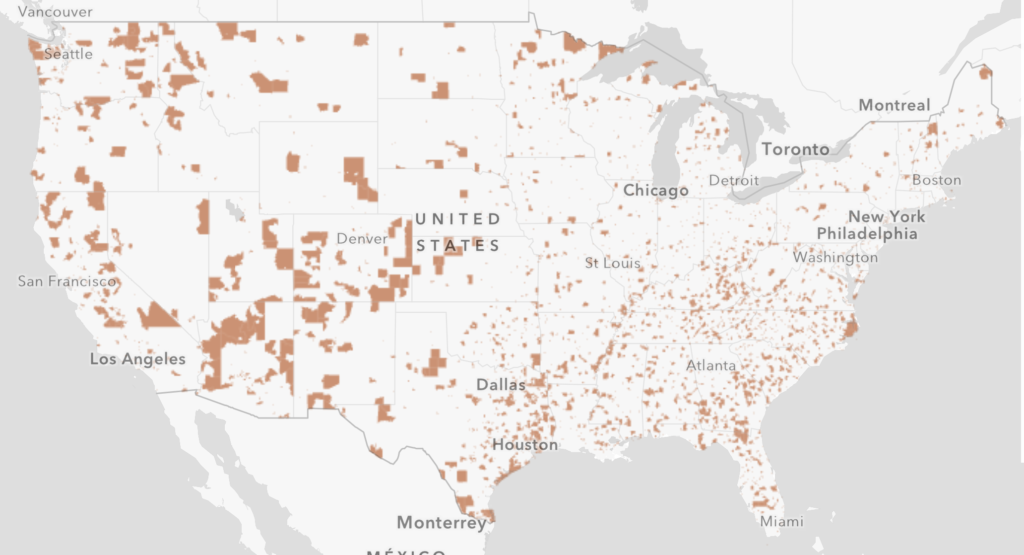

Economic Opportunity Zones (EOZs) are a powerful tool designed to revitalize distressed communities and stimulate economic growth. Established through the Tax Cuts and Jobs Act of 2017, these designated areas offer tax incentives to investors who invest in businesses and real estate projects within their boundaries. While the program’s success hinges on various factors, understanding the nuances of the map that defines these zones is crucial for investors, developers, and community stakeholders alike.

Understanding the Map: A Visual Representation of Potential

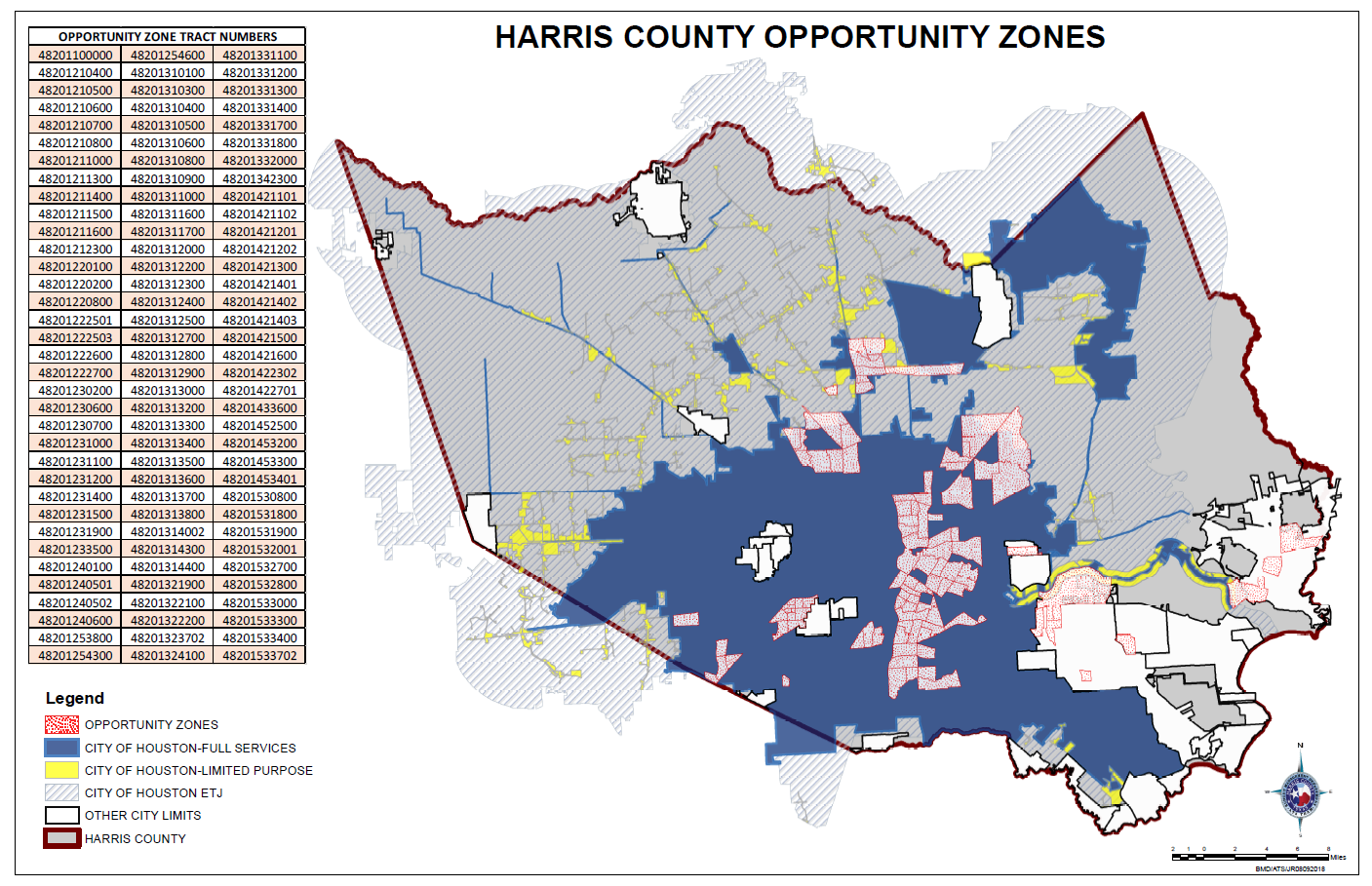

The Economic Opportunity Zone map is a visual representation of the designated areas across the United States. It is a crucial tool for anyone seeking to understand the program’s scope and identify potential investment opportunities. The map is often presented in various formats, including:

- Interactive maps: These maps, usually found on government websites or specialized platforms, allow users to zoom in on specific areas, view detailed information about individual zones, and filter data based on various criteria.

- Static maps: These maps are often displayed on printed materials or presentations and provide a general overview of the designated areas.

- Data visualizations: These tools, often used in research reports or analyses, utilize charts, graphs, and other visual representations to highlight key trends and patterns within the Economic Opportunity Zone map.

Beyond the Boundaries: Delving Deeper into the Data

The map is not merely a visual representation; it serves as a gateway to a wealth of data that can inform investment decisions. Key data points associated with Economic Opportunity Zones include:

- Socioeconomic indicators: These data points, such as poverty rates, unemployment rates, and median income levels, highlight the specific challenges faced by communities within designated zones and provide insights into their potential for growth.

- Demographic information: Data on population density, age distribution, and educational attainment levels offers a glimpse into the human capital available within each zone and helps investors understand the potential workforce for their projects.

- Infrastructure and accessibility: Information regarding transportation networks, access to utilities, and proximity to major economic hubs provides insights into the logistical challenges and opportunities within each zone.

- Local economic development plans: These documents, often developed by local governments or community organizations, outline strategies for revitalizing the designated areas and provide valuable insights into the priorities and potential projects within each zone.

The Importance of the Economic Opportunity Zone Map: A Catalyst for Development

The Economic Opportunity Zone map serves as a powerful tool for various stakeholders:

- Investors: The map allows investors to identify potential investment opportunities in underserved communities, providing access to data that can help them assess risk and return potential.

- Developers: The map helps developers identify areas with high potential for real estate development, guiding them towards projects that align with the program’s goals of economic revitalization.

- Community stakeholders: The map provides valuable insights into the economic landscape of their communities, empowering them to advocate for projects that address local needs and foster sustainable growth.

- Government agencies: The map serves as a critical tool for monitoring the program’s effectiveness and ensuring that investments are targeted towards areas with the greatest need.

Navigating the Map: A Step-by-Step Guide

- Identify your goals: Determine your specific objectives for investing in Economic Opportunity Zones, such as generating tax benefits, supporting community development, or pursuing real estate investment opportunities.

- Explore the map: Utilize interactive maps or data visualizations to identify potential zones that align with your goals and criteria.

- Analyze data: Review socioeconomic indicators, demographic information, infrastructure data, and local economic development plans to gain a comprehensive understanding of each zone’s potential.

- Connect with local stakeholders: Reach out to community organizations, government agencies, and local businesses to gather insights and identify potential partnerships.

- Develop a strategy: Formulate a clear investment strategy that aligns with the specific characteristics of the chosen zone and contributes to the overall goals of economic revitalization.

FAQs Regarding the Economic Opportunity Zone Map:

Q: How are Economic Opportunity Zones designated?

A: The designation process involves a multi-step approach:

- Nomination: States nominate census tracts based on poverty levels, unemployment rates, and other socioeconomic factors.

- Review: The U.S. Treasury Department reviews the nominations and determines the final designations.

- Mapping: The designated areas are then mapped and made publicly available.

Q: What are the tax benefits of investing in Economic Opportunity Zones?

A: Investors who invest in qualified Opportunity Funds can benefit from:

- Deferred capital gains tax: Capital gains realized from the sale of an asset can be deferred until the investment is sold or exchanged, with a potential for complete elimination of capital gains tax if the investment is held for at least 10 years.

- Step-up in basis: The basis of the investment can be stepped up to the fair market value at the end of the 10-year holding period, further reducing capital gains taxes.

- Reduced capital gains tax: A 15% capital gains tax rate applies to investments held for at least 10 years, compared to the usual rates of 20% or 23.8%.

Q: Are there any specific requirements for investing in Economic Opportunity Zones?

A: Yes, investments must be made through qualified Opportunity Funds, which are specifically designed to invest in businesses and real estate projects within designated zones. These funds must meet certain criteria, including:

- Investment focus: At least 90% of the fund’s assets must be invested in businesses and real estate projects within designated zones.

- Investment duration: Investments must be held for at least 10 years to qualify for the full tax benefits.

- Reporting requirements: Opportunity Funds are subject to specific reporting requirements to ensure compliance with the program’s guidelines.

Q: Can anyone invest in Economic Opportunity Zones?

A: While the program is open to all investors, there are certain requirements and considerations:

- Accredited investors: Opportunity Funds are typically only available to accredited investors, meaning they must meet specific financial criteria.

- Minimum investment amounts: Opportunity Funds often have minimum investment amounts that may vary depending on the fund’s structure and investment strategy.

- Investment expertise: Investing in Opportunity Funds requires a certain level of financial sophistication and understanding of the program’s rules and regulations.

Tips for Navigating the Economic Opportunity Zone Map:

- Consult with financial advisors: Seek professional guidance from financial advisors or tax professionals to understand the intricacies of the program and its implications for your specific investment goals.

- Conduct thorough due diligence: Thoroughly research potential investment opportunities, including the track record of the Opportunity Fund, the specific project details, and the potential risks and rewards.

- Engage with local communities: Build relationships with local stakeholders to gain insights into the specific needs and priorities of the community and identify potential partnerships.

- Stay informed about program updates: The Economic Opportunity Zone program is constantly evolving, so it is crucial to stay informed about any changes to the rules, regulations, or reporting requirements.

Conclusion: A Path Towards Sustainable Development

The Economic Opportunity Zone map is a valuable tool for understanding the program’s scope and identifying potential investment opportunities. By leveraging the map’s data and resources, investors, developers, and community stakeholders can play a crucial role in revitalizing distressed communities and fostering sustainable economic growth.

However, it is important to remember that the program’s success depends on a multi-faceted approach that involves collaboration between government agencies, investors, developers, and local communities. By working together, stakeholders can harness the power of Economic Opportunity Zones to create a more equitable and prosperous future for all.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Opportunity: A Comprehensive Guide to Economic Opportunity Zones. We thank you for taking the time to read this article. See you in our next article!