Navigating The Landscape Of Property Ownership: Understanding The DuPage County Tax Map

Navigating the Landscape of Property Ownership: Understanding the DuPage County Tax Map

Related Articles: Navigating the Landscape of Property Ownership: Understanding the DuPage County Tax Map

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape of Property Ownership: Understanding the DuPage County Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Property Ownership: Understanding the DuPage County Tax Map

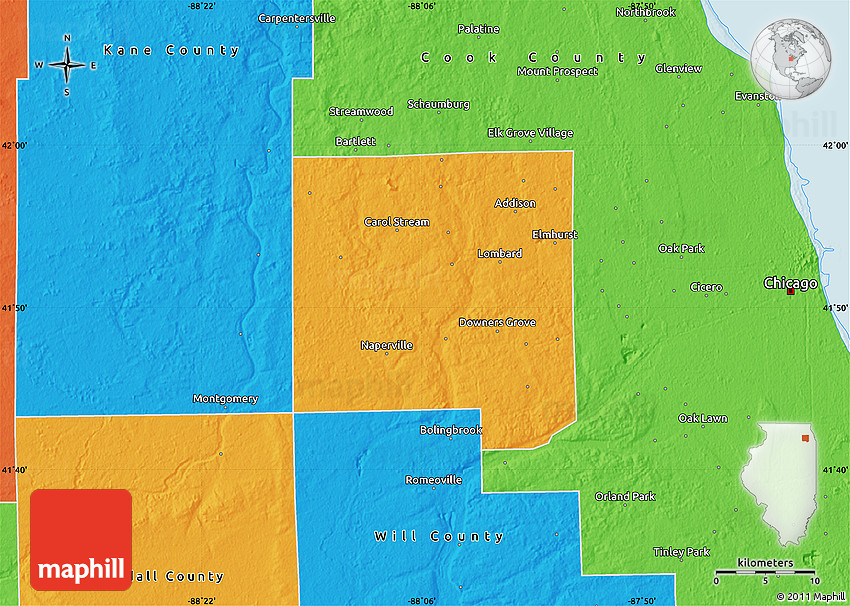

The DuPage County Tax Map serves as a fundamental tool for understanding and navigating the intricate world of property ownership within the county. It is a comprehensive visual representation of all parcels of land, meticulously organized and categorized for easy identification and reference. This digital map, accessible through the DuPage County Assessor’s website, provides a wealth of information vital to property owners, potential buyers, real estate professionals, and even local government agencies.

Decoding the Map’s Significance:

The DuPage County Tax Map is not merely a static visual; it is a dynamic repository of critical data. Its significance lies in its ability to:

- Clarify Property Boundaries: Each parcel on the map is clearly defined by its unique identification number, legal description, and precise boundaries. This eliminates ambiguity and disputes regarding property ownership.

- Provide Property Details: The map reveals key information about each property, including its size, location, zoning classification, and even its estimated market value. This data empowers informed decision-making for various purposes.

- Facilitate Property Transactions: Buyers and sellers can leverage the map to gain a comprehensive understanding of the property they are considering. This facilitates informed negotiations and minimizes potential surprises.

- Aid in Property Management: Property owners can utilize the map to track their holdings, monitor property values, and identify potential development opportunities. This ensures effective management of their real estate assets.

- Support Local Governance: The map plays a crucial role in the assessment and taxation process, ensuring fair and transparent property valuation for all residents. It also aids in planning and development decisions by providing insights into land use patterns.

Navigating the Map’s Features:

The DuPage County Tax Map is designed for user-friendliness and accessibility. Its key features include:

- Interactive Interface: Users can zoom, pan, and navigate the map with ease, exploring specific areas of interest.

- Search Functionality: Users can search for properties by address, parcel number, owner name, or other criteria.

- Detailed Information Panels: Clicking on a specific parcel displays a wealth of information, including property details, assessment records, and tax information.

- Layer Options: The map allows users to overlay various data layers, such as zoning, schools, and public transportation, providing a comprehensive view of the surrounding environment.

- Downloadable Formats: Users can download map data in various formats, including PDF, KML, and shapefiles, for further analysis and integration with other applications.

Unveiling the Map’s Applications:

The DuPage County Tax Map serves a diverse range of purposes, from everyday property management to complex real estate transactions. Here are some key applications:

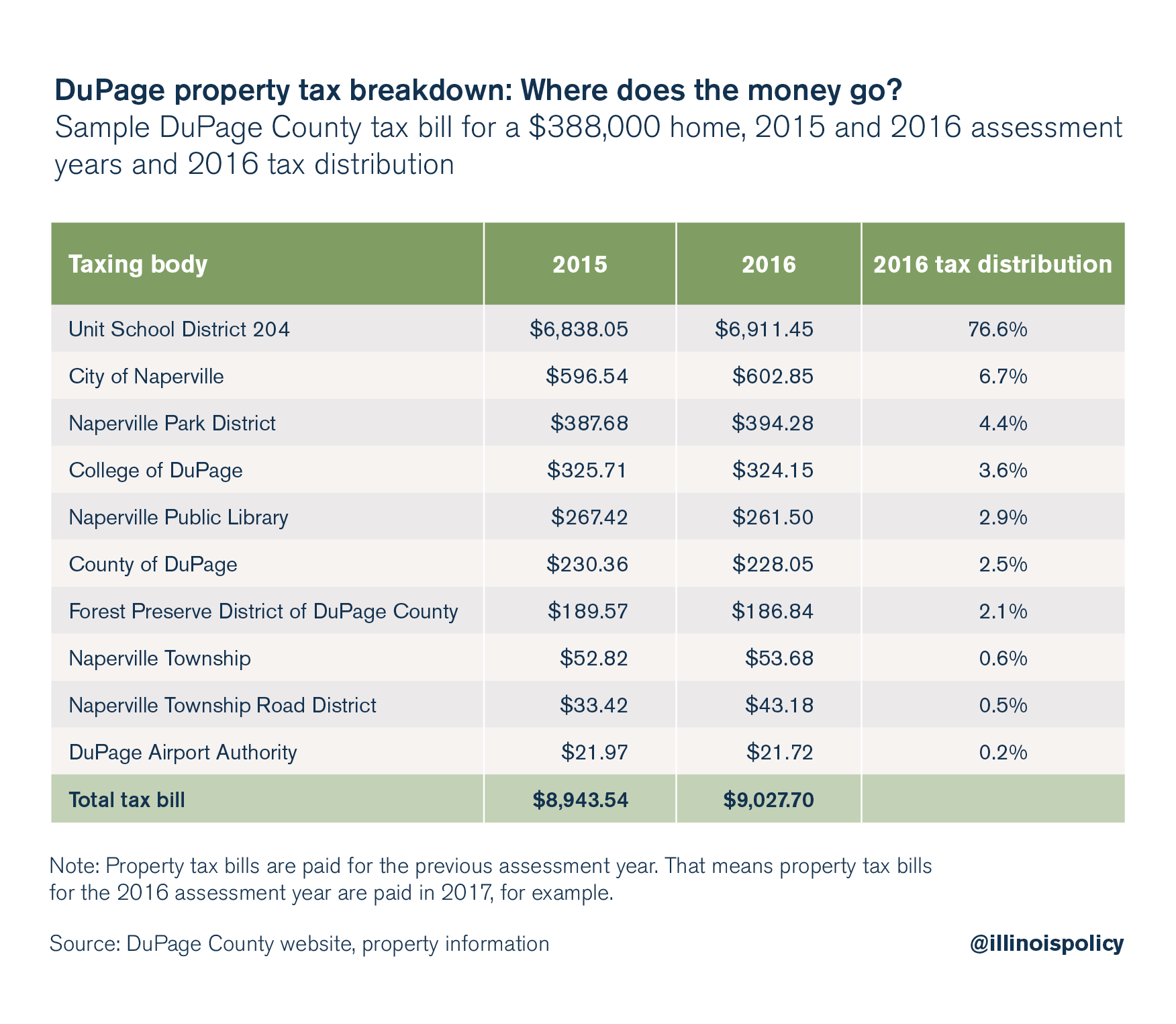

- Property Valuation and Assessment: The map provides the foundation for assessing property values, ensuring fair and equitable taxation across the county.

- Real Estate Transactions: Potential buyers and sellers can use the map to identify properties, understand their characteristics, and make informed decisions.

- Property Development and Planning: Developers can utilize the map to identify suitable locations for projects, analyze zoning regulations, and plan infrastructure development.

- Land Use Management: Local government agencies rely on the map to monitor land use patterns, identify areas requiring attention, and implement effective planning policies.

- Public Access and Transparency: The map promotes transparency by providing readily accessible information about property ownership, values, and assessments to all citizens.

FAQs: Addressing Common Questions

Q: How can I access the DuPage County Tax Map?

A: The map is freely accessible through the DuPage County Assessor’s website. You can access it directly through the website’s "Maps & Data" section.

Q: What information is available on the map?

A: The map provides a wide range of information, including property boundaries, parcel numbers, legal descriptions, zoning classifications, property values, and tax information.

Q: Can I use the map to determine the value of my property?

A: While the map provides estimated market values, it is crucial to consult with a qualified real estate professional for accurate property valuation.

Q: How can I use the map for property development purposes?

A: The map can help identify suitable locations, analyze zoning regulations, and plan infrastructure development. However, consulting with local planning authorities is essential for obtaining necessary permits and approvals.

Q: Is the information on the map always accurate?

A: While the DuPage County Assessor strives to maintain accurate data, it’s essential to verify information through official sources or consult with relevant professionals.

Tips for Effective Map Utilization:

- Familiarize Yourself with the Interface: Take some time to explore the map’s features, including search functions, zoom controls, and data layers.

- Understand the Terminology: Familiarize yourself with property-related terminology, such as parcel number, legal description, and zoning classifications.

- Verify Information: Always cross-check data from the map with official records or consult with relevant professionals for accurate information.

- Utilize Data Layers: Experiment with different data layers to gain a more comprehensive understanding of the surrounding environment.

- Contact the Assessor’s Office: If you have any questions or require assistance, contact the DuPage County Assessor’s office for support.

Conclusion: A Vital Resource for Property Owners and Stakeholders

The DuPage County Tax Map serves as a vital resource for property owners, real estate professionals, and local government agencies. Its comprehensive nature, user-friendly interface, and wealth of information make it an invaluable tool for navigating the complexities of property ownership and management. By understanding its features and applications, individuals and organizations can leverage the map to make informed decisions, promote transparency, and contribute to the sustainable development of DuPage County.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Property Ownership: Understanding the DuPage County Tax Map. We hope you find this article informative and beneficial. See you in our next article!