Navigating The Ocean County Tax Map: A Comprehensive Guide For Property Owners And Residents

Navigating the Ocean County Tax Map: A Comprehensive Guide for Property Owners and Residents

Related Articles: Navigating the Ocean County Tax Map: A Comprehensive Guide for Property Owners and Residents

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Ocean County Tax Map: A Comprehensive Guide for Property Owners and Residents. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Ocean County Tax Map: A Comprehensive Guide for Property Owners and Residents

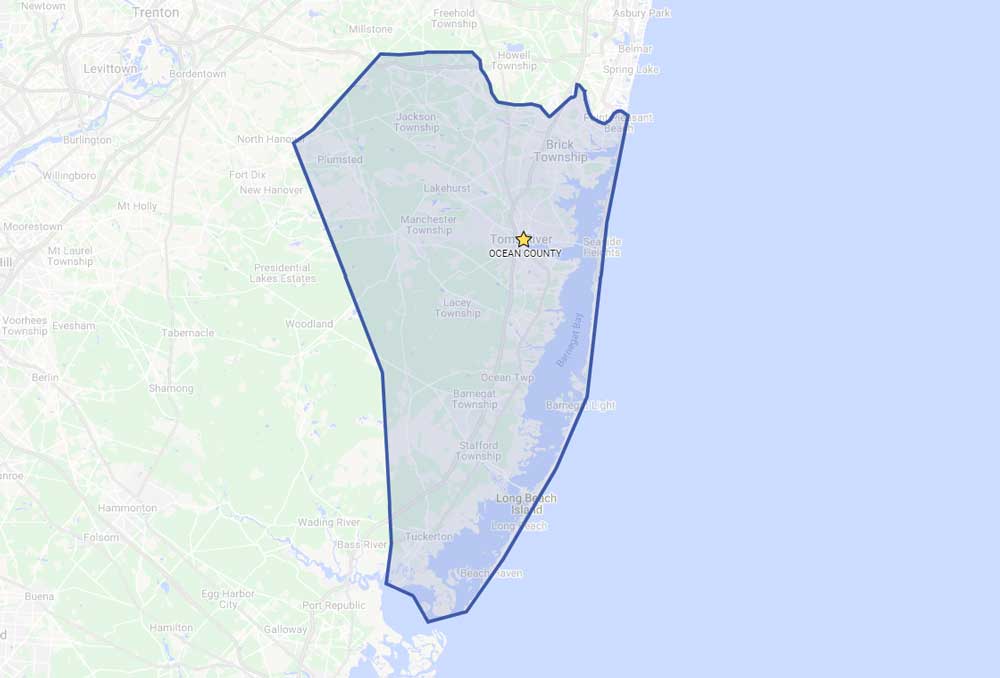

The Ocean County Tax Map serves as a vital resource for residents, property owners, and businesses, providing a detailed and accessible visual representation of the county’s real estate landscape. This map, accessible online and in physical formats, facilitates understanding of property boundaries, tax assessments, and other crucial information.

Understanding the Ocean County Tax Map

The Ocean County Tax Map is a comprehensive system that organizes and depicts all parcels of land within the county. Each parcel is assigned a unique identification number, known as the Block and Lot number, which serves as its unique identifier. This system ensures that every property can be easily located and identified within the map.

The map itself is a visual representation of the county, divided into sections known as Blocks. Within each Block, individual parcels of land are numbered as Lots. Each Lot represents a distinct property, including residential homes, commercial buildings, vacant land, and other types of real estate.

Key Features of the Ocean County Tax Map

The Ocean County Tax Map offers a wealth of information, making it an indispensable tool for various purposes. Here are some key features:

- Property Boundaries: The map clearly outlines the boundaries of each parcel, providing a precise visual representation of property lines. This information is crucial for property owners, surveyors, and developers.

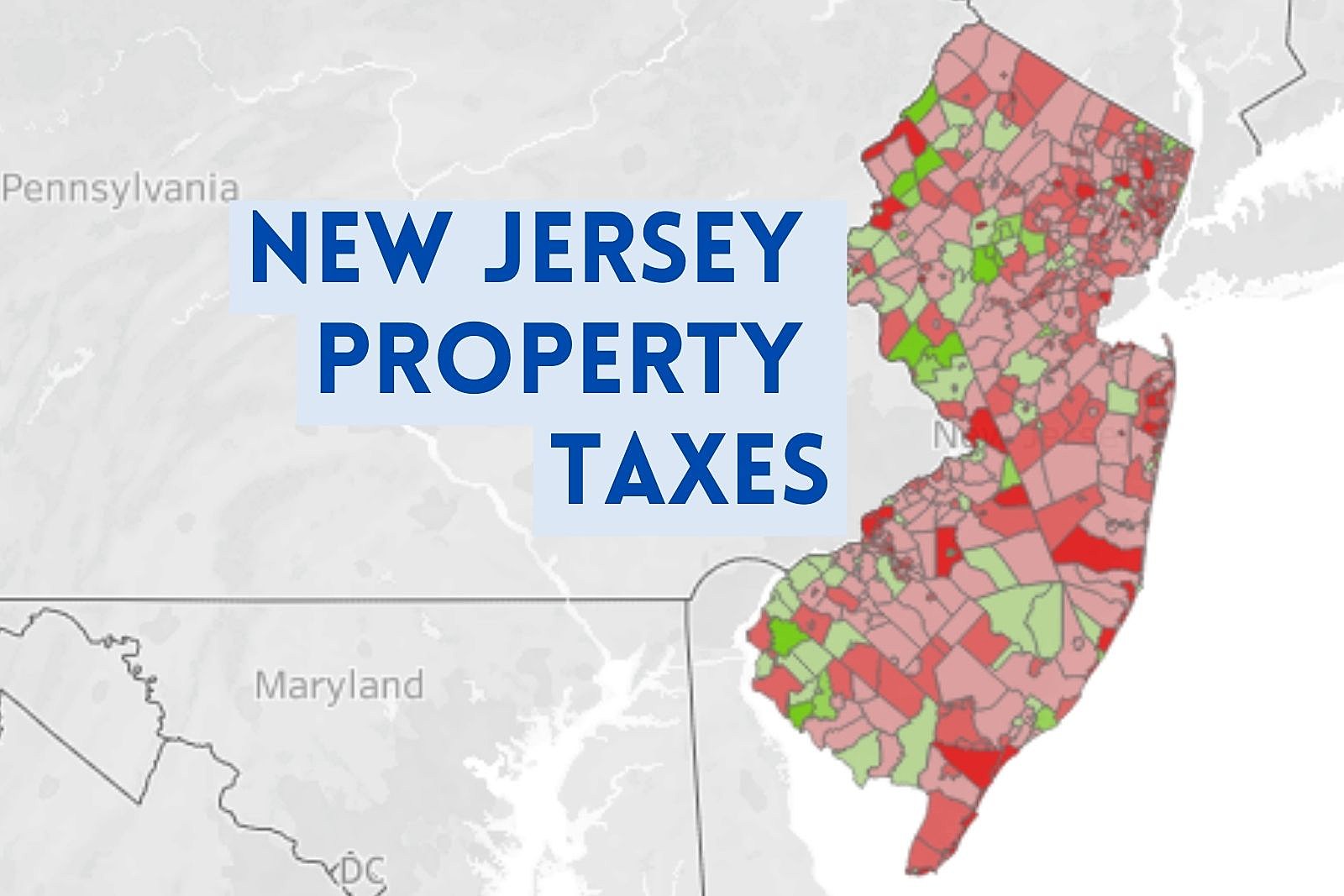

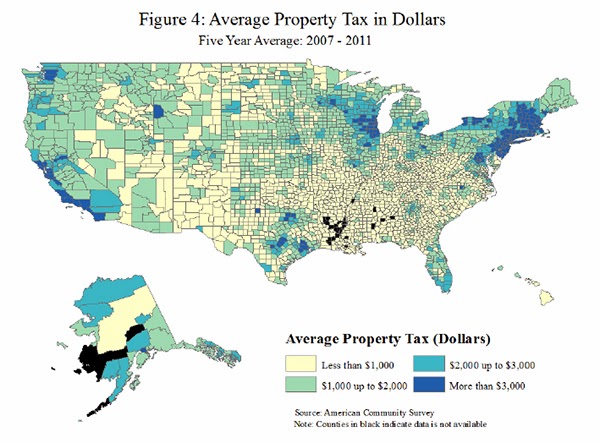

- Tax Assessments: The map includes information about the assessed value of each property. This value is used to calculate property taxes, providing transparency and accountability in the tax system.

- Property Ownership: The map often includes information about the current owners of each property, including their names and contact details. This information is valuable for property research, investment opportunities, and legal purposes.

- Zoning Regulations: The map may also incorporate information about zoning regulations applicable to each property, indicating permitted uses and development restrictions.

- Utilities: The map may display the location of essential utilities, such as water lines, sewer lines, and electrical grids, providing a comprehensive understanding of infrastructure within the county.

Accessing the Ocean County Tax Map

The Ocean County Tax Map is readily accessible through various channels:

- Online: The Ocean County Tax Assessor’s website provides a user-friendly online interface for accessing the map, allowing users to search for specific properties by address, Block and Lot number, or owner’s name.

- Physical Copies: The Ocean County Tax Assessor’s office also offers physical copies of the map, available for public inspection during business hours.

- GIS Data: The county may also offer the map data in Geographic Information System (GIS) format, enabling advanced analysis and visualization for specialized applications.

Benefits of Using the Ocean County Tax Map

The Ocean County Tax Map offers numerous benefits for various stakeholders:

- Property Owners: The map provides a clear understanding of their property boundaries, tax assessments, and zoning regulations, empowering them to make informed decisions regarding their property.

- Real Estate Professionals: Real estate agents, brokers, and appraisers utilize the map to research property values, identify potential investments, and understand the local real estate market.

- Developers: Developers rely on the map to assess the feasibility of development projects, understand zoning restrictions, and plan infrastructure requirements.

- Government Officials: The map assists government officials in managing property records, planning for infrastructure development, and administering tax collection.

- Residents: The map helps residents understand their neighborhood, identify local amenities, and gain insight into the overall development of their community.

FAQs about the Ocean County Tax Map

Q: How do I find my property on the Ocean County Tax Map?

A: You can locate your property on the online map by entering your address, Block and Lot number, or owner’s name. Alternatively, you can visit the Ocean County Tax Assessor’s office to obtain a physical copy of the map.

Q: What information is included on the map for each property?

A: The map typically displays property boundaries, tax assessments, ownership information, zoning regulations, and sometimes utilities. The specific information may vary depending on the map’s version and intended purpose.

Q: How often is the Ocean County Tax Map updated?

A: The map is updated periodically to reflect changes in property ownership, assessments, and other relevant information. The frequency of updates varies, but it is generally maintained to ensure accuracy and relevance.

Q: Can I use the map to dispute my property taxes?

A: While the map provides information about your property’s assessed value, it is not a direct tool for tax dispute resolution. However, it can be a valuable resource for understanding your assessment and gathering supporting information for a potential appeal.

Q: Is the Ocean County Tax Map available in digital format?

A: Yes, the map is typically available online and may also be offered in GIS format. Contact the Ocean County Tax Assessor’s office for specific details about digital access.

Tips for Utilizing the Ocean County Tax Map

- Familiarize yourself with the map’s layout: Understand the organization of Blocks and Lots, and learn how to navigate the map’s features.

- Use the search function: The online map often includes a search bar for quickly finding specific properties.

- Verify information: Always confirm information obtained from the map with official records and sources.

- Consult with professionals: For complex inquiries or legal matters, seek advice from a real estate attorney, surveyor, or tax professional.

Conclusion

The Ocean County Tax Map serves as a comprehensive and valuable tool for understanding the county’s real estate landscape. Its detailed information on property boundaries, tax assessments, ownership, and zoning regulations makes it an indispensable resource for property owners, real estate professionals, developers, government officials, and residents. By utilizing the map, stakeholders can gain valuable insights, make informed decisions, and navigate the intricacies of real estate in Ocean County.

![]()

Closure

Thus, we hope this article has provided valuable insights into Navigating the Ocean County Tax Map: A Comprehensive Guide for Property Owners and Residents. We appreciate your attention to our article. See you in our next article!