Unlocking Dillon County’s Land Records: A Comprehensive Guide To The Dillon County Tax Map

Unlocking Dillon County’s Land Records: A Comprehensive Guide to the Dillon County Tax Map

Related Articles: Unlocking Dillon County’s Land Records: A Comprehensive Guide to the Dillon County Tax Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unlocking Dillon County’s Land Records: A Comprehensive Guide to the Dillon County Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Unlocking Dillon County’s Land Records: A Comprehensive Guide to the Dillon County Tax Map

- 2 Introduction

- 3 Unlocking Dillon County’s Land Records: A Comprehensive Guide to the Dillon County Tax Map

- 3.1 Understanding the Dillon County Tax Map: A Visual Guide to Land Ownership

- 3.2 Accessing the Dillon County Tax Map: Navigating the Information Highway

- 3.3 The Importance of the Dillon County Tax Map: Unlocking the Secrets of Land Ownership

- 3.4 Frequently Asked Questions (FAQs) About the Dillon County Tax Map

- 3.5 Tips for Using the Dillon County Tax Map Effectively

- 3.6 Conclusion: The Dillon County Tax Map – A Gateway to Land Information

- 4 Closure

Unlocking Dillon County’s Land Records: A Comprehensive Guide to the Dillon County Tax Map

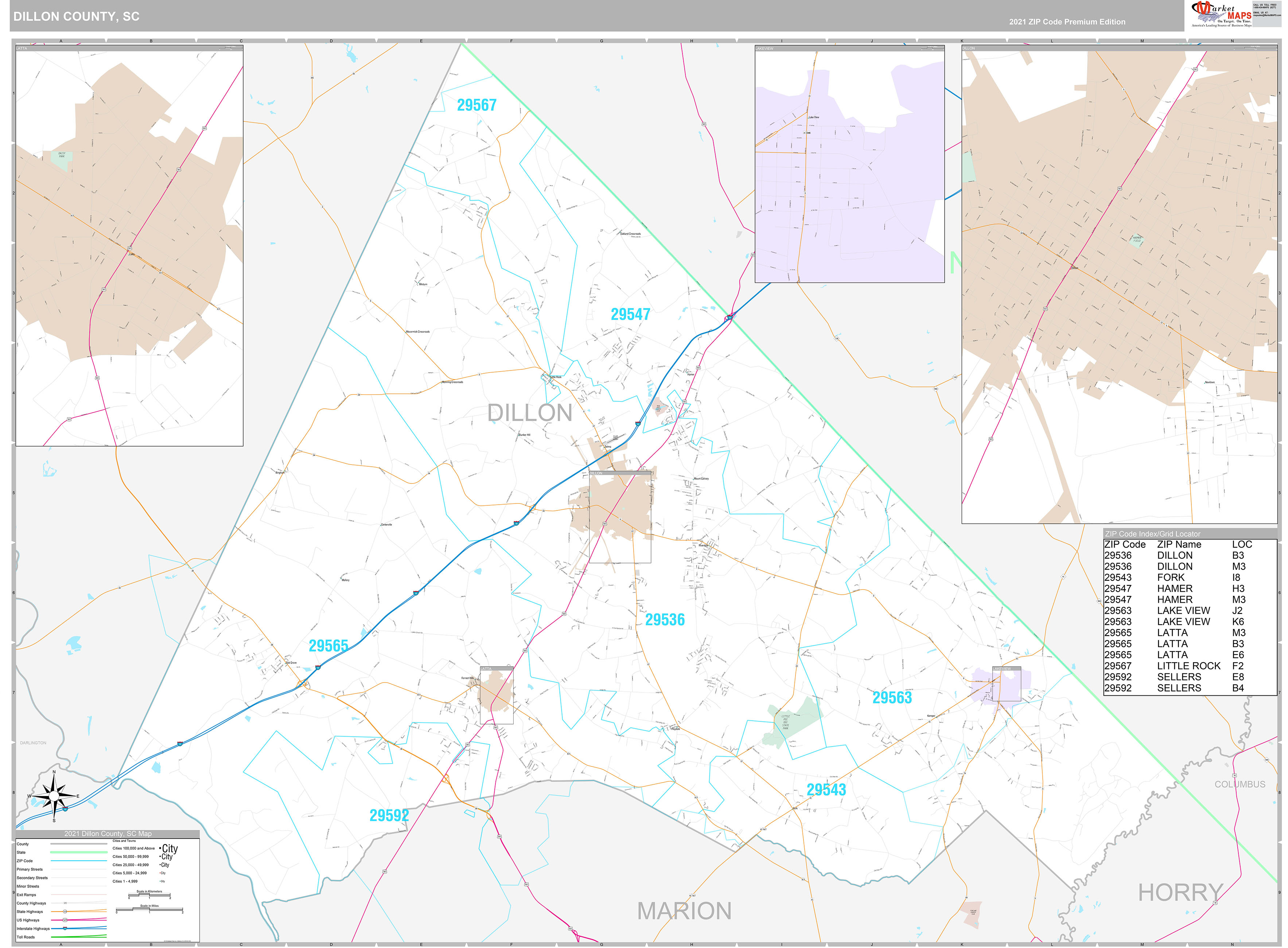

Dillon County, South Carolina, boasts a rich history and a diverse landscape, from the rolling hills of the Pee Dee region to the scenic shores of Lake Waccamaw. Understanding the intricate web of land ownership within this county is crucial for various stakeholders, including property owners, potential buyers, developers, and even historians. The Dillon County Tax Map serves as a vital tool in navigating this complex landscape, providing a visual and detailed representation of property boundaries, ownership information, and associated tax data.

Understanding the Dillon County Tax Map: A Visual Guide to Land Ownership

The Dillon County Tax Map, often referred to as the "tax assessor’s map," is a comprehensive graphical representation of all taxable properties within the county. It is essentially a large-scale map, meticulously divided into individual parcels, each identified by a unique parcel number. These parcels are then further categorized based on property type (residential, commercial, agricultural, etc.) and ownership details.

Key Features of the Dillon County Tax Map:

- Parcel Identification: Each property is assigned a unique parcel number, serving as its primary identifier within the map and county records.

- Property Boundaries: The map accurately depicts the boundaries of each parcel, providing a clear visual representation of the extent of individual property ownership.

- Ownership Information: The map includes details about the current owner of each parcel, including their name and contact information.

- Tax Data: The map displays relevant tax information, such as the assessed value of the property and any outstanding taxes.

- Location References: The map uses various reference points, such as roads, rivers, and landmarks, to clearly locate individual parcels within the county.

Accessing the Dillon County Tax Map: Navigating the Information Highway

The Dillon County Tax Map is typically maintained and updated by the Dillon County Assessor’s Office. Access to the map can be obtained through various methods:

- Online Access: The Dillon County Assessor’s Office may provide online access to the tax map through its website. This allows users to search for specific parcels by address, parcel number, or owner name.

- In-Person Access: Individuals can visit the Dillon County Assessor’s Office in person to view the tax map and obtain printed copies.

- Third-Party Services: Several third-party companies specialize in providing access to property records, including tax maps, for a fee.

The Importance of the Dillon County Tax Map: Unlocking the Secrets of Land Ownership

The Dillon County Tax Map plays a crucial role in various aspects of land management and development within the county. Its significance extends beyond simple property identification, serving as a vital tool for:

- Real Estate Transactions: The map provides essential information for real estate agents, buyers, and sellers, helping them accurately identify properties, verify ownership, and assess property values.

- Property Development: Developers and builders utilize the tax map to identify available parcels, assess property boundaries, and plan infrastructure projects.

- Tax Assessment and Collection: The Dillon County Assessor’s Office relies on the tax map to determine property values for tax assessment purposes, ensuring fair and accurate tax collection.

- Land Use Planning: The map serves as a valuable resource for county planners in developing land use regulations, zoning policies, and infrastructure projects.

- Historical Research: The tax map can provide valuable insights into land ownership patterns and historical development within Dillon County.

Frequently Asked Questions (FAQs) About the Dillon County Tax Map

Q1: What is the purpose of the Dillon County Tax Map?

The Dillon County Tax Map serves as a comprehensive visual representation of all taxable properties within the county. It helps identify individual parcels, determine ownership, and access related tax information.

Q2: How can I access the Dillon County Tax Map?

The Dillon County Tax Map can be accessed online through the Dillon County Assessor’s Office website, in person at the Assessor’s Office, or through third-party services.

Q3: What information is included on the Dillon County Tax Map?

The tax map displays parcel numbers, property boundaries, ownership information, tax data, and location references.

Q4: How often is the Dillon County Tax Map updated?

The Dillon County Tax Map is typically updated on a regular basis, reflecting changes in property ownership, boundaries, and tax information.

Q5: Can I use the Dillon County Tax Map to identify a specific property?

Yes, the tax map can be used to identify properties by address, parcel number, or owner name.

Q6: What are the benefits of using the Dillon County Tax Map?

The tax map provides valuable information for real estate transactions, property development, tax assessment, land use planning, and historical research.

Q7: Are there any fees associated with accessing the Dillon County Tax Map?

Fees may apply for accessing the tax map through third-party services. However, accessing the map through the Dillon County Assessor’s Office may be free of charge.

Q8: How can I contact the Dillon County Assessor’s Office for assistance?

Contact information for the Dillon County Assessor’s Office can be found on their website or through local directory services.

Tips for Using the Dillon County Tax Map Effectively

- Utilize Online Resources: The Dillon County Assessor’s Office website may offer interactive map features, allowing users to zoom in, pan around, and search for specific parcels.

- Search by Different Criteria: Explore search options based on address, parcel number, owner name, or property type to locate desired properties.

- Check for Updates: Regularly check the Dillon County Assessor’s Office website or contact them directly for the most recent updates to the tax map.

- Verify Information: Always double-check information obtained from the tax map with official records or relevant authorities.

- Seek Professional Assistance: Consult with a real estate professional, surveyor, or legal expert if you require detailed information or assistance with interpreting the tax map.

Conclusion: The Dillon County Tax Map – A Gateway to Land Information

The Dillon County Tax Map serves as an indispensable tool for understanding and navigating land ownership within the county. Its comprehensive nature, detailed information, and accessibility make it a valuable resource for various stakeholders, including property owners, real estate professionals, developers, and even historians. By providing a clear visual representation of property boundaries, ownership details, and tax data, the tax map plays a vital role in promoting transparency, facilitating informed decision-making, and fostering responsible land management within Dillon County.

Closure

Thus, we hope this article has provided valuable insights into Unlocking Dillon County’s Land Records: A Comprehensive Guide to the Dillon County Tax Map. We thank you for taking the time to read this article. See you in our next article!